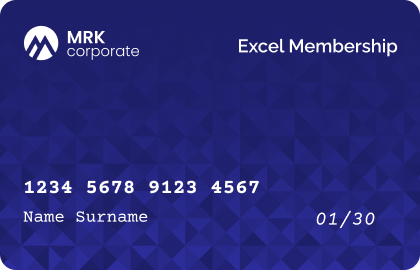

Excel Membership Card

- Unlocking The Best Personal Loans

Use your Excel Membership Card to apply for a personal loan with one of our NBFC partners.

The Excel Membership Card from MRK Corporate is a cutting-edge and highly efficient way to obtain pre-approved personal loan offers from numerous partnered NBFCs as well as personalized financial counseling! Yes, when you buy a membership card, you become entitled to use a number of personal loan services we offer in addition to receiving offers for rapid loan pre-approval.

Rs. 1299.00 499.00 only

Buy Now

Excellent Features of Excel Membership Card

Offers Of Pre-approved Loans From Affiliated NBFCs

Following the collection of your loan-related paperwork, we will swiftly submit your loan application to our affiliated NBFCs. The NBFC banks will next review your profile and compare it to the requirements for their particular loan eligibility programme. The loan offers from the NBFCs that match your profile will then be given to you.

1 months of Free Financial Expert Consultation

We firmly believe in supporting you with all of our power! Obtaining a membership card serves the same function by allowing you to receive free professional consultation that will direct you towards improved financial planning.

Receive A 40% Referral Bonus

Along with receiving financial advice and pre-approved loan offers from Our Partnered NBFCs, you can also earn a significant income by using our simple refer and share feature and up to 40% in referral commission.

Online Only Process

Due to the process being entirely digital, you may access the greatest financial consultation and services available anywhere. You can take advantage of our excellent consultation while lounging on your couch.

Outstanding On-Call Support

We are more than delighted to get in touch with you via our on-call assistance in order to dispel your uncertainties and address your concerns. You will be able to find the right answers to all of your questions by doing this.

Nothing Affects CIBIL Score

One of the major benefits of purchasing an Excel Membership Card is that, even after repeated NBFC verifications, the loan applicant's CIBIL score would remain unaffected.

Most Optimized Way Towards Personal Loan - How it works?

1. Signing up

2. Verify Eligibility

3. Purchase a membership card

4. Submit Paperwork

5. Verification by a Bank

6. Bank Sanction

Here, at https://MRKCorporate.com/terms-conditions, you can view the full company Terms & Conditions.